Vibes.

Have you ever made a shopping decision that you regretted? You shouldn’t have to.

With VIBES, you can make smarter, more informed decisions about what you buy and when you buy it.

This project was completed in my Human Factors class with three other students.

My Role

Project Leader

UI Design

User Research

Timeline

8 Weeks

Our Problem

Students tend to have an educational barrier from financial literacy, preventing them from creating beneficial financial decisions and habits.

Our Users

College students struggling to make beneficial financial decisions and maintain healthy habits.

Our Solution

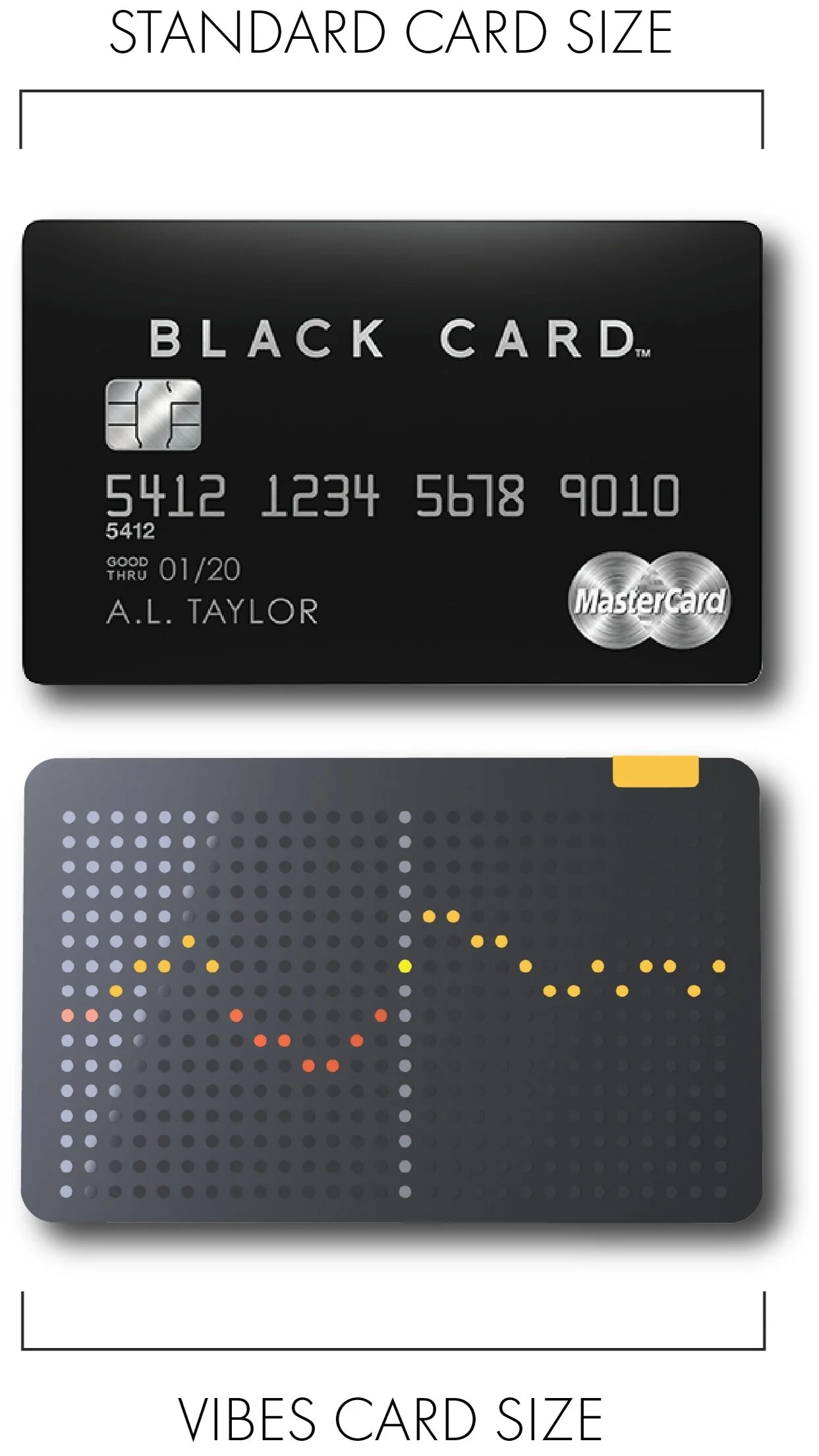

A collaboration of hardware and software that aims to prevent impulsive purchases by exposure to cash flow and vibration reminders when you’re about to make a purchase.

Make the best decisions when it comes your purchases.

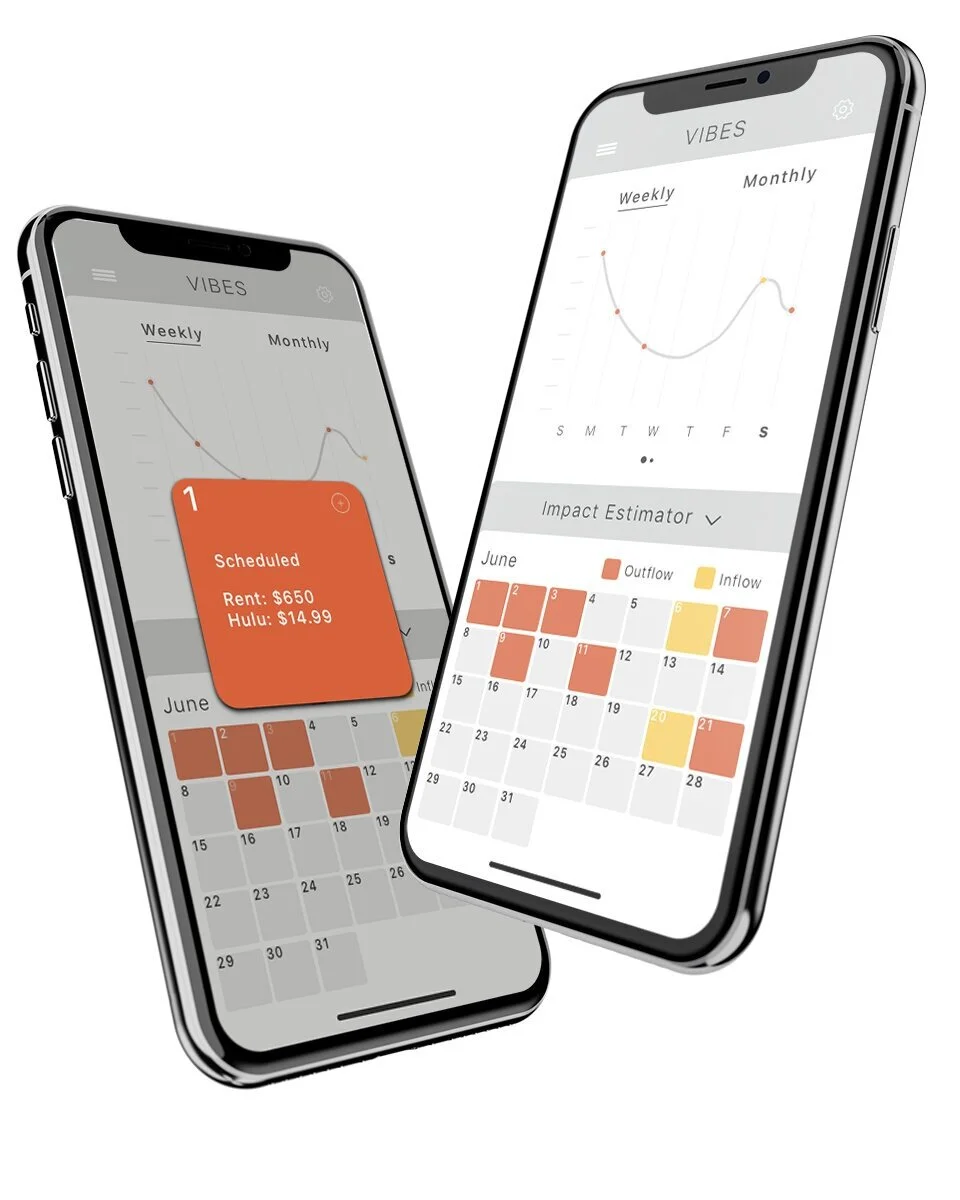

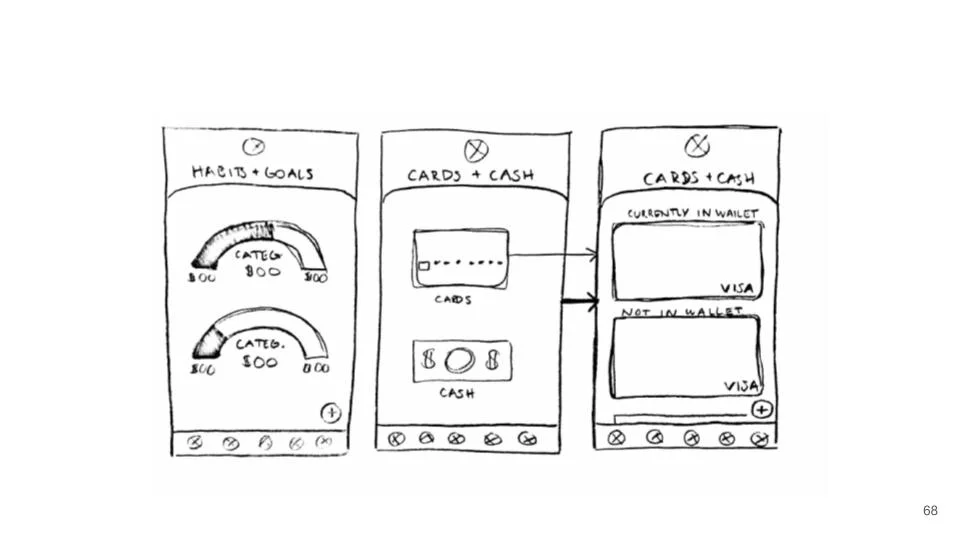

The VIBES card tracks every inflow and outflow of your credit cards, debit cards, and cash in your wallet. Both the application and the card are constantly sharing information with each other, so the user always has the ability to check updated information whenever and wherever.

Plan for the future.

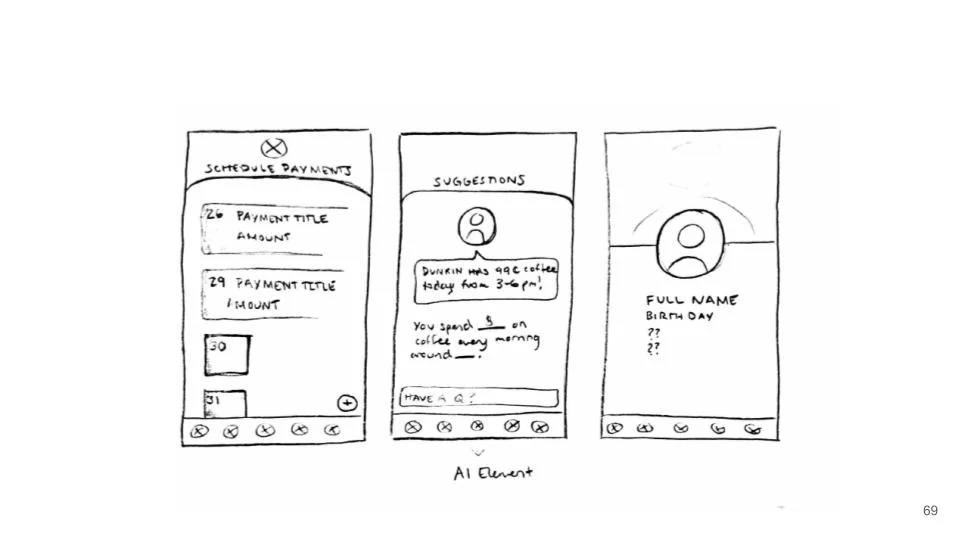

Schedule and track your money outflows and inflows to help you plan ahead. This tool will help you visually see when you will be spending and receiving money and give insights on your financial future.

Is this purchase right for you?

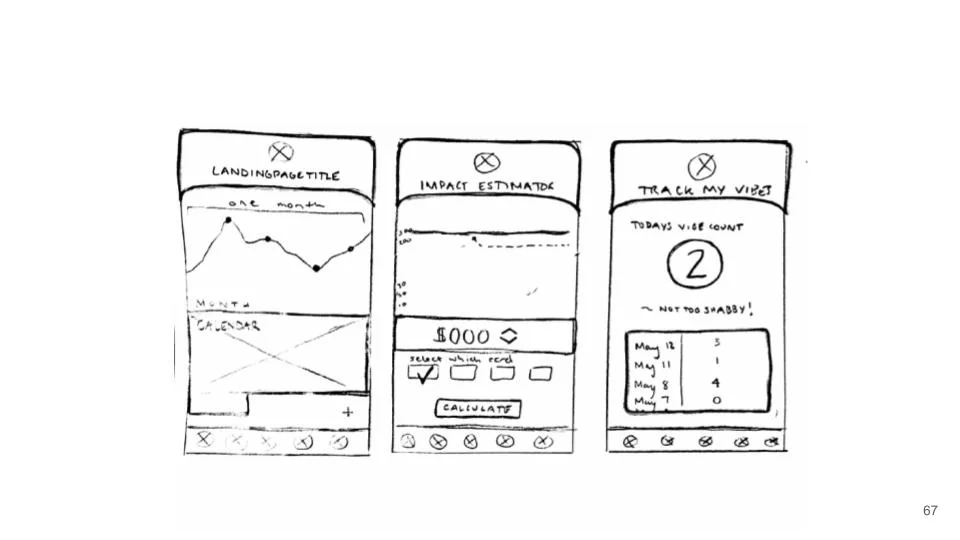

Use the impact estimator to see if the purchase you are about to make is right for you. Grab your phone, enter in the price, and let the graph show you how big of an impact it will make.

Our Process

To begin, we sent out a survey reaching out to all young adults and college students to gain insights on financial barriers and budgeting. We received 44 responses.

Did you take a personal finance class in High School?

Do you have an easier time budgeting when there’s a goal?

Do you find budgeting easy or hard?

“I find it hard because I am a very impulsive person, so it’s difficult for me to plan out my purchases.”

Student

Age 18-23

What are your biggest frustrations with budgeting?

“I get bored and just spend money not realizing that I have to pay bills in the next few days.”

Student

Age 18-23

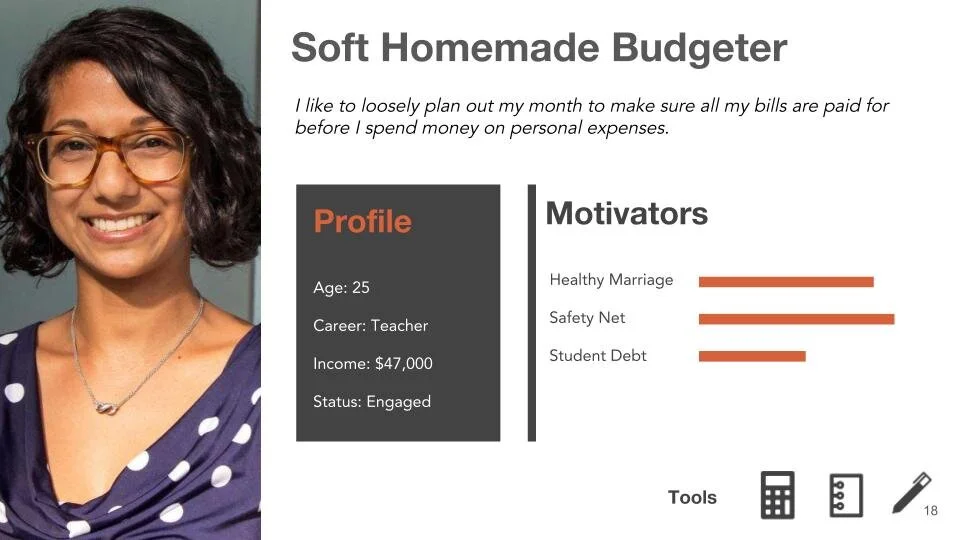

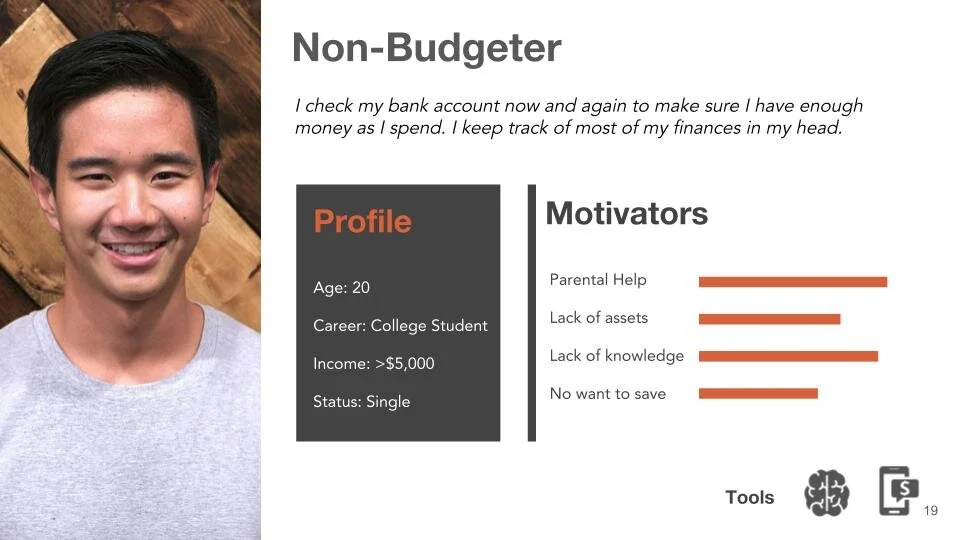

From the information gathered during our survey and interviews, my team and I came up with three personas. We aimed to target all types of budgeters such as, a hardcore budgeter, a soft homemade budgeter, and a non-budgeter.

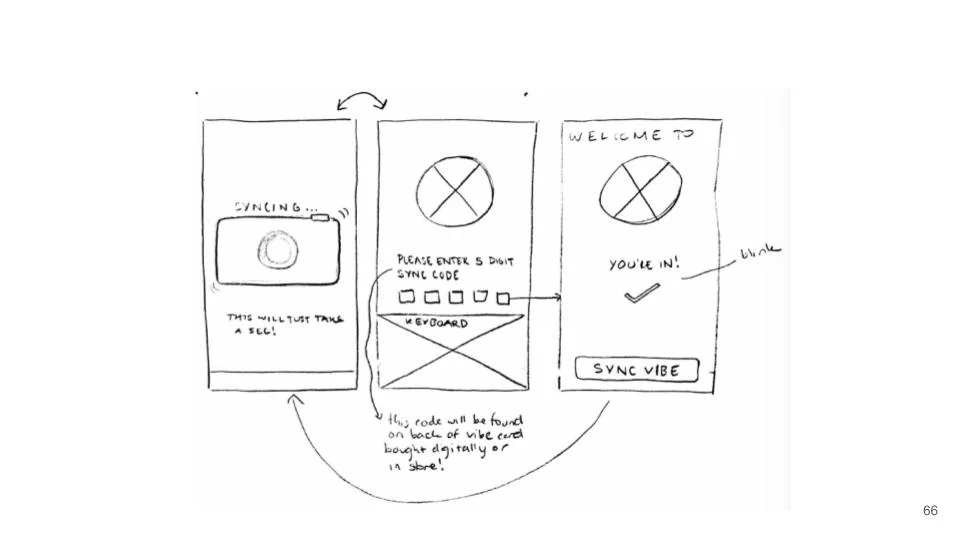

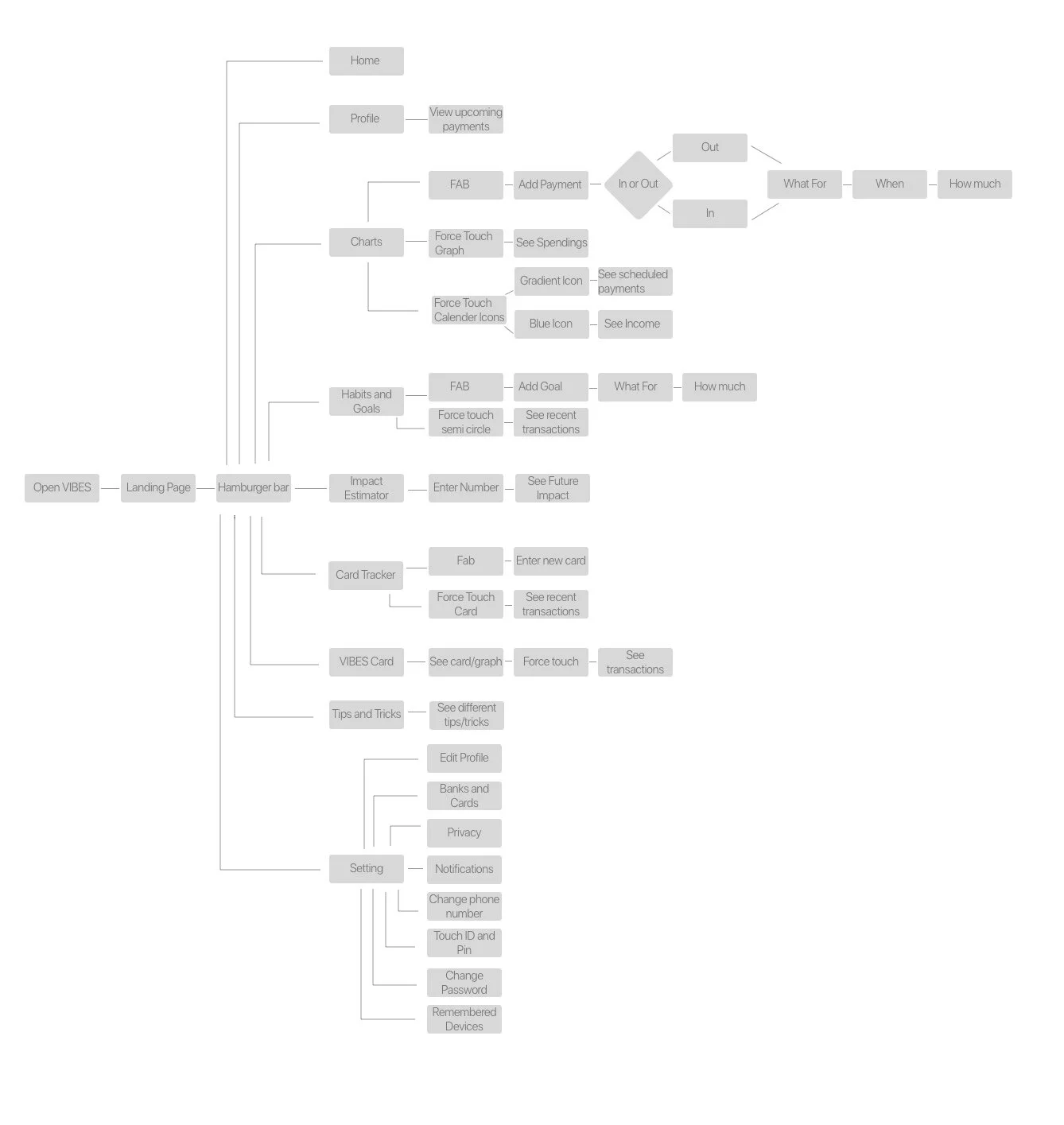

Once we completed our research phase, we moved into sketching possible layouts and gathering all the information. Before moving into our final mockups, we designed a flowchart to visually showcase the flow of our application.

Final Screen Descriptions

Personalized Screens

One of our main goals when creating Vibes was to make sure that each screen was extremely personalized. Every user will have customized landing screens that specifically fit their needs.

Our Impact

Helping students make smarter and more informed choices when it comes to their

financial future.